The integration of Generative AI (GenAI) into the Banking and Insurance sectors is not just a futuristic concept; it’s already a present-day reality shaping the operational landscape of these industries. This post explores how GenAI is reinventing various facets of banking and insurance on the basis of OpeX-AI on-the-ground experience.

Banking Sector

- Customer Service: GenAI significantly enhances interaction quality and personalization in customer service. By employing a new generation of AI-driven chatbots and virtual assistants, banks can offer personalized and efficient service, leading to improved customer satisfaction and loyalty.

- Risk Management: The application of GenAI in risk management is revolutionary. It facilitates the generation of automated risk reports, offering real-time insights and aiding in proactive risk mitigation, a critical aspect for any financial institution.

- Investment Research: GenAI transforms investment research by summarizing and providing insights from extensive research materials. This not only streamlines the research process but also equips investment analysts with valuable, distilled information, aiding in informed decision-making.

- Compliance: In the realm of compliance, GenAI plays a crucial role by ensuring internal rules are aligned with regulatory requirements. This automation significantly reduces the risk of non-compliance and the associated penalties.

- Loan Underwriting: The acceleration of loan underwriting processes through GenAI is noteworthy. It enhances the efficiency and accuracy of creditworthiness assessments, significantly reducing the processing time for loan applications.

- Wealth Management: GenAI aids in proposing investment ideas and pitches, providing a personalized touch to wealth management services. It enables the creation of customized investment strategies that cater to individual client needs.

- Code Translation and Modernization: A unique application in banking is the automation of code modernization and translation. This is particularly beneficial for banks dealing with legacy systems, ensuring their software infrastructure remains up-to-date and secure.

- Automated Reporting: GenAI also streamlines reporting processes, generating on-demand reports from various data sources. This enhances the efficiency and accuracy of financial reporting, a vital aspect of banking operations.

Insurance Sector

- Claim Triage: In insurance, GenAI automates the evaluation and categorization of claims, a process known as claim triage. This leads to quicker and more accurate processing of claims, enhancing overall operational efficiency.

- Compliance Verification: Similar to banking, GenAI in insurance verifies if internal rules align with regulatory requirements, ensuring compliance and reducing the risk of regulatory breaches.

- Claims Management: Automating claim processing and routing them to the appropriate adjusters dramatically improves the efficiency of the claims management process. This automation reduces processing time and enhances customer satisfaction.

- Claim Liquidation: The automation of claim liquidation streamlines the final and critical phase of the claims process, ensuring timely and accurate settlement of claims.

- Customer Service Enhancement: Just as in banking, GenAI in insurance significantly improves the quality and personalization of customer service, providing customers with more tailored and responsive support.

- Code Translation and Modernization: The application of GenAI for code translation and modernization is equally important in insurance, especially for firms modernizing their IT infrastructure and ensuring software efficiency and security.

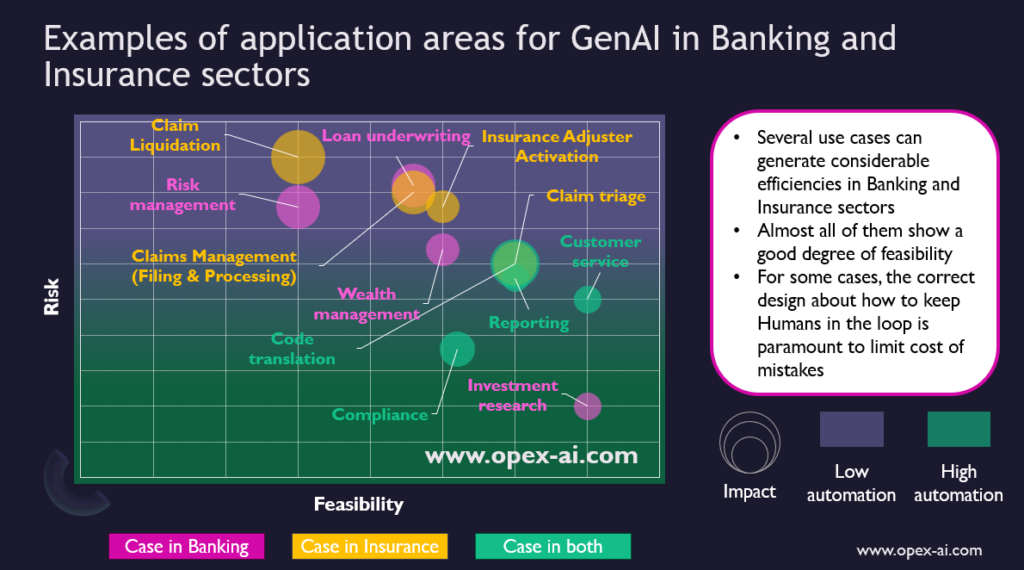

Clearly, the above-mentioned cases don’t have the same degree of feasibility, impact on the bottom line, or risks. However, the wide application of GenAI across various areas in Banking and Insurance demonstrates its potential to revolutionize these sectors. From enhancing customer service to streamlining complex operational processes like compliance and claim management, GenAI stands as a pivotal technology. Its ability to personalize services, improve operational efficiency, and ensure compliance and security highlights its transformative impact. As the financial world increasingly embraces digital innovation, GenAI emerges as a key player in shaping the future of banking and insurance operations.